i Solve Payroll: A Modern Approach to Hassle-Free Pay Processing

May 5, 2025 | by derniseh@gmail.com

Why i Solve Payroll Is Essential for Today’s Businesses

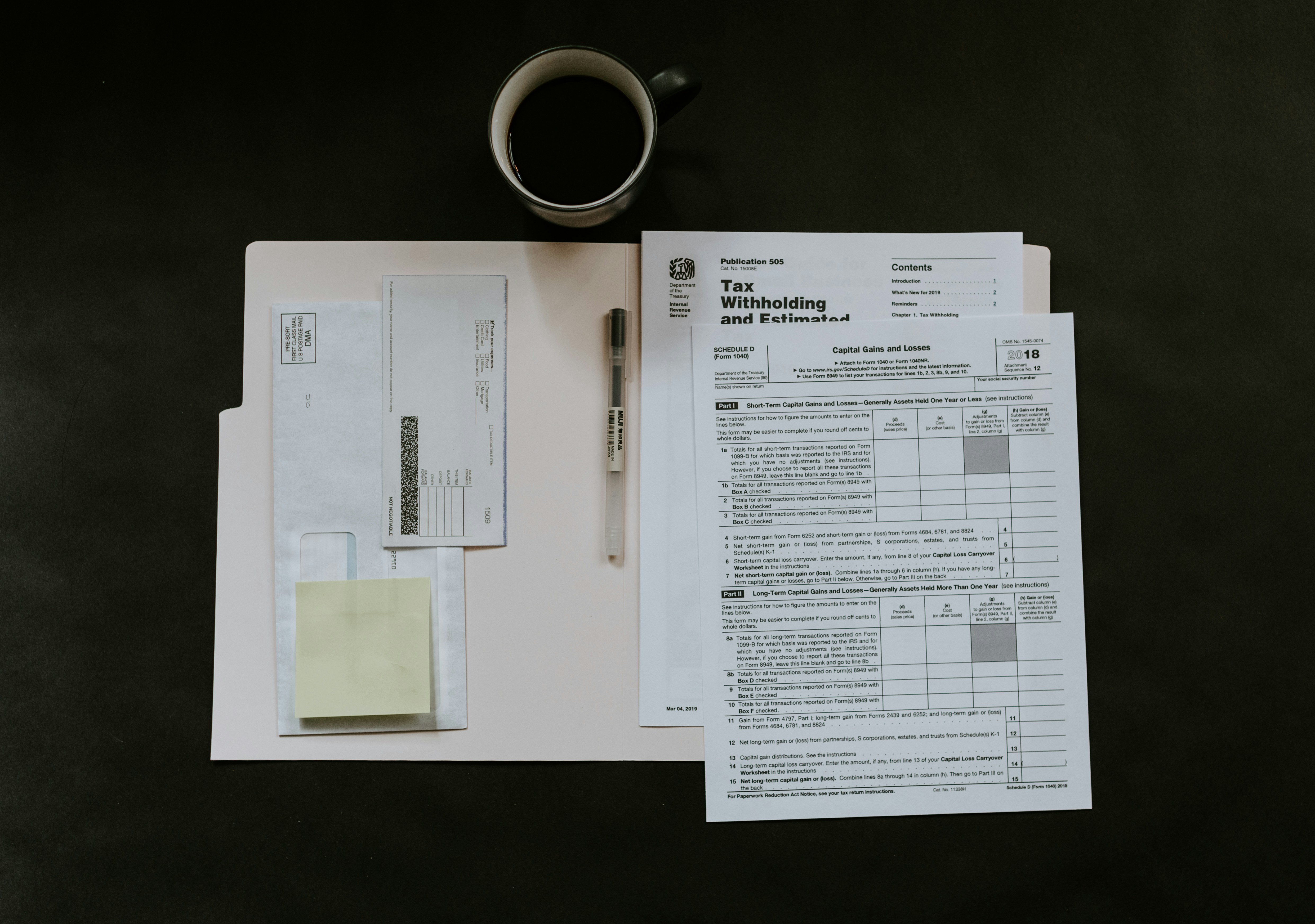

Processing payroll manually is time-consuming and error-prone, exposing companies to compliance risks and frustrated employees. i Solve Payroll automates every step—from data collection through tax filing—so you can focus on growing your business rather than wrestling with spreadsheets. Below, we explore five pillars that make i solve payroll the go-to solution for small and mid-sized organizations.

1. Fully Automated Pay Calculations

- Precision Engine: i Solve Payroll computes gross-to-net pay instantly, factoring in wages, overtime, bonuses, and deductions without manual intervention.

- Rule Library: Built-in wage-and-hour rules (overtime thresholds, shift differentials) ensure every paycheck is accurate and compliant.

- Batch Processing: Run payroll for multiple pay schedules and locations with one click—no need to toggle between modules or screens.

Benefit: Eliminates calculation errors and slashes pay-run time from hours to minutes.

2. Employee Self-Service & Transparency

- Digital Pay Stubs: Team members access current and historical pay statements, tax forms, and deduction breakdowns via mobile or desktop.

- Direct-Deposit Management: Employees update bank accounts or add secondary accounts on their own—reducing HR inquiries and delays.

- Leave & Time-Off Integration: PTO requests and time-clock data feed directly into payroll calculations, giving employees full visibility into their balances.

Benefit: Empowers staff with 24/7 access to their payroll data, boosting trust and reducing support tickets.

3. Compliance & Tax Filing Safeguards

- Automatic Tax Updates: i Solve Payroll stays current with federal, state, and local tax tables—applying rate changes and new regulations instantly.

- E-Filing & Payment: File payroll taxes electronically and schedule payments through the platform—no more manual deposit slips or late-payment penalties.

- Audit-Ready Records: Maintain a secure, tamper-evident archive of all payroll reports, filings, and employee acknowledgments for easy audits.

Benefit: Minimizes tax-penalty risk and ensures you meet every jurisdiction’s filing deadlines.

4. Seamless System Integrations

- Time & Attendance Sync: Connect your existing punch-clock or scheduling software to import hours worked automatically—eliminating data entry.

- HRIS & ERP Connectors: Link with HR systems, accounting packages, and benefits platforms to synchronize employee data, general-ledger entries, and insurance deductions.

- API Access: For custom workflows, use i Solve Payroll’s REST API to push or pull payroll data into your proprietary applications.

Benefit: Creates a unified data ecosystem—streamlining workflows and reducing reconciliation headaches.

5. Real-Time Reporting & Analytics

- Dashboard Overviews: View labor-cost percentages, headcount snapshots, and pay-run summaries in real time—filterable by department, pay period, or location.

- Custom Report Builder: Generate ad-hoc reports on gross wages, tax liabilities, benefit deductions, and more—exportable to Excel or PDF.

- Trend Analysis: Track payroll costs over time to identify seasonal spikes, overtime hotspots, or staffing inefficiencies.

Benefit: Equips leaders with actionable insights to optimize staffing, control expenses, and forecast labor budgets accurately.

RELATED POSTS

View all